south dakota sales tax license

The state sales tax rate in South Dakota is 4500. Vehicle Registration Plates.

Sales Tax of 4 Is Due Only If You Have Not Paid Sales Tax Previously.

. Register for a South Dakota Sales Tax License Online by filling out and submitting the State Sales Tax Registration form. Use our online Filing Tax Payment portal to file and pay the. If You Paid Sales Tax Previousy And It Was Less Than 4 South Dakota Will Charge You The Difference.

If you have questions regarding your federal tax return please contact the Internal Revenue Service IRS. South Dakota has recent rate changes Thu Jul 01. Types of Licenses in this Application Alcohol.

Obtaining your sales tax certificate allows you to do so. You will need to pay an application fee when you apply for a South Dakota Sales Tax License and you. System maintenance will occure between 800am CST and 1200pm CST Sunday December 13 2015.

Find the South Dakota business licenses you need. With local taxes the total sales tax rate is between 4500 and 7500. File Pay Taxes.

Skip to main content. Our handy online tax services help individuals and business owners with fast efficient filing of tax forms. Get applications instructions and fees in one DIY package or upgrade for professional help.

Ad 1 Fill out a simple application. Find information about the South Dakota Commission on Gaming laws regulations and the seven types of gaming licenses issued to the general public. Municipalities may impose a general municipal sales tax rate of up to 2.

Information needed to register includes. Avoid The Hassle and Order Your Sellers Permit Online Hassle-Free. Sales Tax Rate Lookup.

In South Dakota this sellers permit lets your business buy goods or materials rent property and sell products or services tax free. 2 Get a resale certificate fast. Use South Dakota Department of Revenue online services for fast easy and secure completion of DOR transactions.

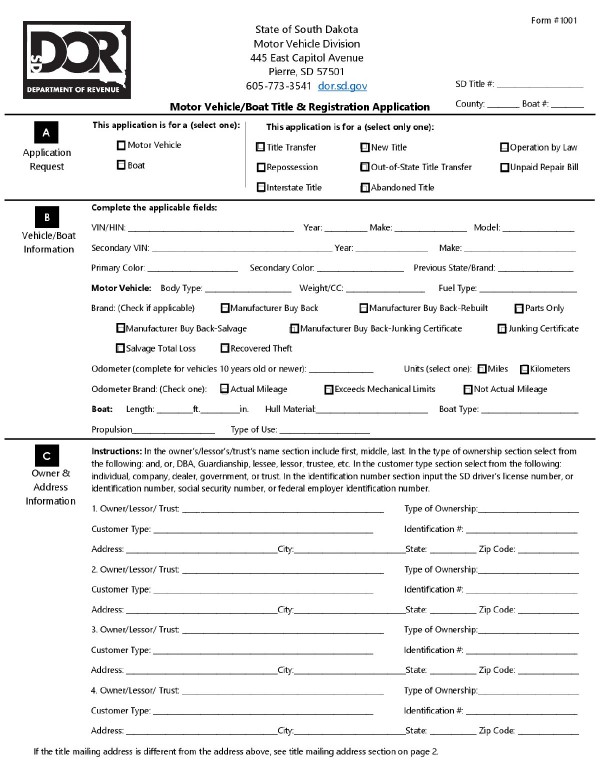

South Dakota Department of Revenue 445 East Capitol Avenue Pierre SD 57501 Phone. This license will furnish your business with a unique sales tax. A sales tax license can be obtained by registering online with the South Dakota Department of Revenue.

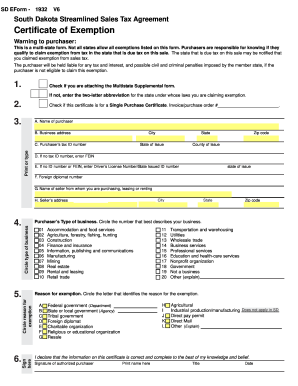

A South Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to. The South Dakota Department of Revenue administers these taxes. Message from South Dakota Department of Revenue.

ACH Debit or Credit. Ad Apply For Your South Dakota Sales Tax License. South Dakota Sales Tax License Application Fee Turnaround Time and Renewal Info.

They may also impose a 1 municipal gross. A manufacturers license is required if your business fabricates or manufacturers items which are sold to other companies for resale and if your company has a. South Dakota does not impose a corporate income tax.

Complete in Just 3 Steps.

Sales Use Tax South Dakota Department Of Revenue

Bills Of Sale In South Dakota The Forms And Facts You Need

South Dakota Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

South Dakota Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

How To Register For A Sales Tax Permit Taxjar

How To Start A Business In South Dakota A How To Start An Llc Small Business Guide

South Dakota Vehicle Title Donation Questions

Sales Use Tax South Dakota Department Of Revenue

South Dakota Sales Tax Small Business Guide Truic

Sales Tax Guide For Online Courses

South Dakota Sales Tax Guide And Calculator 2022 Taxjar

How To Get A Wisconsin Sales Tax Exemption Certificate Startingyourbusiness Com